MASTER IN MANAGEMENT | FINANCE (M.SC.)

Full-time Study Program

Building business-ready skills at the crossroads of strategy and finance with the Master in Management | Finance

In this unique program we combine corporate finance expertise with profound management skills. We take you beyond standard thinking of short-run financial performance and company value maximization. Instead, we strengthen your abilities to critically reflect and to arrive at well-informed business decisions. Providing our students with competencies of sustainable impact is at HHL‘s heart of mind. Furthermore you will benefit from our renowned career counseling and broaden your global perspective through intensive cross-cultural experiences. The HHL Campus with its inspiring multicultural atmosphere is located in the heart of Leipzig and offers you the perfect environment for your study experience.

At a glance

- Degree: M.Sc. | 120 ECTS

- Location: Leipzig

- Language: English

- Start: September

- Duration: 21-24 months

- Application deadline: June 30 (non-EU candidates: May 31)

- Eligibility: Bachelor degree in a business-related program, 3 months work experience

Five Reasons for HHL’s Master in Management | Finance

- Where Finance Meets Strategy: Deepen your finance expertise while sharpening strategic and management skills.

- Theory in Action: Learn through case studies, guest lectures, and hands-on workshops with industry leaders.

- Career Launchpad: Benefit from expert coaching, a strong alumni and company network, and top-tier career opportunities (#1 in Europe for graduate salaries).

- Global Perspective: Study abroad at one of 140 partner universities – with no additional tuition fees.

- Flexible & Personalized: Tailor your studies to your goals, with optional modules and up to three internships

The HHL Master in Management | Finance: Program Overview

1. Welcome Weeks

Kicking off a new life chapter at HHL

New students starting their journey at HHL are welcomed with open arms during the vibrant Welcome Weeks. It’s more than just an introduction; it’s a celebration of #hhlspirit. From program introductions to on-campus adventures, these weeks forge friendships that span programs and continents. Events like the Welcome BBQ, an exciting dragon boat tour, the city-wide team rally and the Campus Games not only foster togetherness, but help to strengthen our unique HHL community. Together, we forge bonds that last far beyond graduation and create a support network that is as diverse as it is sustainable.

2. Finance Prep

Get fit for Finance

Our blended learning modules on the basics of studying finance allow you to self-assess your expertise, refresh acquired skills, and fill gaps. All modules are optional and can be taken according to your individual needs.

- Fundamentals of Accounting

- Business Modelling in Excel

- Mathematics and Statistics

- Fundamentals of Finance

3. Essentials

Essentials: Learn what counts

This is where you start your HHL journey and take a deep breath of our school’s DNA. We do not only onboard your diverse class in what is essential in terms of hard skills but also develop your entrepreneurial spirit as well as your sense for teamwork and community. Moreover, we want to help you in becoming the best version of yourself by learning meaningful self-leadership frameworks and gaining awareness for the cross-functional abilities needed to excel in a modern business world.

4. Elective Essentials

Elective Essentials: Lay the foundation

While studying the Master in Management | Finance choose at least two out of the three highlighted modules to prepare for your thrilling ride through the world of finance and strategy. Beyond that, you can select two of the other offerings to dive into something new and to complement your existing skillset with new capabilities.

5. Business Competencies

Practical experience at its best

Whether working with a company on a real-life problem, studying abroad or completing internships, the practical experience you gain, the connections and relationships you build will serve you far beyond graduation and equip you with an invaluable network. A selection of unique opportunities allows you to apply your newly acquired knowledge and skills:

Student Consulting Project

This is a once-in-a-lifetime opportunity to experience what it’s like to be a consultant. Your challenge is to collaborate in a team of four to six students to advise and support a company in solving a real-life problem. Working closely with both company representatives and HHL faculty, you will learn first-hand what it means to initiate real change.

Explore the most recent projects in our blog

Internships

Whether in investment banking, private equity or consulting; with an integrated internship we offer you the opportunity to gain practical insights into new sectors and diverse corporate cultures. This is your chance to gain new perspectives, contacts and experience according to your own unique career goals. In addition to the mandatory internship, you will have the opportunity to complete two additional internships.

6. Finance Focus

Finance Focus: Become an expert that stands out!

The Finance Focus curriculum is carefully composed to turn you into an expert in the field by combining academic excellence with key insights into real-world challenges. While immersing yourself in the exciting world of Finance, we will make sure that you never lose the big picture on strategic implications and decision making.

Financial Decision Making

These modules convey important skills on financial markets, building portfolios, weighing risk and return, valuing investments, structuring M&A deals as well as hedging and insuring risk exposures. Beyond providing safe ground regarding the concepts, the courses focus on direct applications to real-life challenges.

The questions that are addressed span from: What are best-practices in financial planning and how to implement them? How do financial markets work and what are the implications for instruments being traded and market participants? How to insure or hedge against risks? How does an M&A process works?

Advanced Financial Challenges

Modules of this block transform students into experts in investing, financing and pricing assets. The modules provide recent academic advancements in the field and latest practical developments from industry. Students obtain the skills to price any claim they may ever face, enabling them to evaluate any investment, rationalize any risk management strategy, optimize capital structures and shape complex financing contracts.

Moreover, we give students the opportunity to place themselves in the ultimate test, a case study seminar with finance executives. In this capstone seminar, students work in groups towards solving a realistic case mentored, challenged and evaluated by a senior of one of our partner companies.

Full-time Master in Management – Finance Focus (30 ECTS)

| Financial Decision Making | Advanced Financial Challenges |

|---|---|

| Corporate Valuation and Mergers & Acquisitions (5 ECTS) | Financial Instruments & Asset Pricing (5 ECTS) |

| Capital Market Theory & Investments (5 ECTS) | Advanced Corporate Finance & Taxation (5 ECTS) |

| Risk Management of Corporations (5 ECTS) | Case Study Seminar with Finance Executives (5 ECTS) |

7. Master Thesis

Putting the theories into context

Your master thesis – your way. Contribute to the discipline of corporate finance and beyond with a high-class empirical study, a well developed modelling approach, or a

practice-oriented case study.

The master thesis (15 ECTS) can be prepared twofold, in a classic thesis format or as a research paper. The latter offers the opportunity to get published in an academic or applied finance journal. Just in the last two years, theses of our students have been published in journals like Qualitative Research in Financial Markets (Ranked B), Corporate Finance (Ranked D) or Die Wirtschaftsprüfung (WPg) (Ranked C).

Successful theses in finance were published in (exemplatory)

- Qualitative Research in Financial Markets

- Corporate Finance or

- Die Wirtschaftsprüfung.

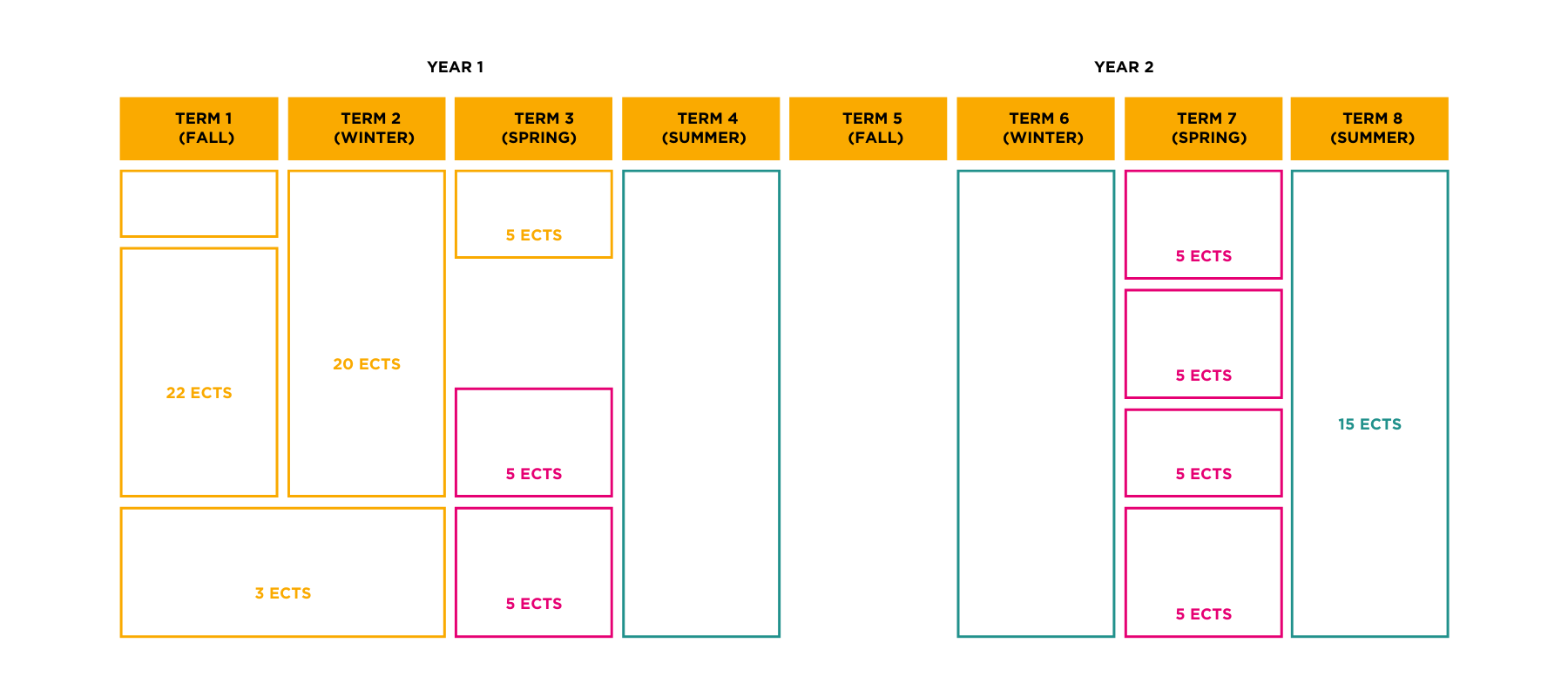

Master in Management | Finance: Program Schedule

*Optional intership before or after the Master Thesis.

International Experience

Term abroad

The world is your oyster at HHL!

International competencies are essential for successful managers, consultants, entrepreneurs and executives in an increasingly globalized world. This is why HHL prioritizes maintaining global partnerships. Whether it’s New York, Paris, Lima, Oslo, Singapore, Hong Kong or Sydney; a term abroad at one of our 140 global partner universities will give you an exciting change of perspective. The HHL team will guide you before, during and after your term abroad. Take advantage of this unique opportunity to explore new countries and new cultures and to expand your own international network.

Double degree option

One more option for you: An additional degree from one of HHL’s partner universities! Aside from your term abroad, you have the option of receiving an additional degree from one of our global network of partner universities. Don’t worry, there’s no need to decide on your international options just yet! And of course, your HHL team is here to support you!

About the double-degree option

Our partner universities with double degree options at a glance:

- University of Adelaide, Australia

- INCAE, Costa Rica

- Aarhus University, Denmark

- Grenoble Ecole de Management, France

- ESC Montpellier, France

- ESC Toulouse, France

- Audencia Nantes, France

- EM Strasbourg, France

- Nagoya University of Commerce, Japan

- Universidad ESAN, Peru

- National Chengchi University, Taiwan

A Master’s program that pays off!

#3

For graduates' salaries in Europe

Financial Times Masters in Management Ranking 2025

#9

Worldwide for Alumni Network

Financial Times Masters in Management Ranking 2025

81,5k

Average starting salary after graduation (EUR)

HHL FT MiM Employment Report 2024

#5

Career Service worldwide

Financial Times Masters in Management Ranking 2025

It’s an easy climb up your career ladder with our HHL Career Service

In a recent Financial Times Master in Management Ranking, our Career Development Team was ranked 5th worldwide! This is no coincidence, as our experienced psychologists and career experts have long perfected the mix of 1-to-1 coaching, personality tests, workshops and other tools.

Our Career Development Team will be at your side throughout your job search. With an average starting salary of EUR 81,600, your investment in our Master in Management | Finance will definitely pay off!

Identify your purpose

- Personality tests

- Career orientation workshops

- Self-leadership training

- Individual coaching

- Webinars

Navigate the job market effectively

- CV & cover letter checks

- CV optimization software VMock

- Interview preparation

- Case study training

- Digital career center with talent bank

- Advice on salary negotiations

- Tips for the onboarding process

Maximize your network

- On-campus company presentations

- On-campus interviews

- Alumni talks

- Company excursions

- Recruiting workshops

- Student consulting projects

- Yearly Career Day

Your networking opportunities with our partner companies are manifold and diverse:

HHL FinNights - Your Fast Track to Finance Career Opportunities

To provide our students with insights into the diverse career paths available in the finance industry, we organize regular career events called “FinNights”. During these events, which take place 3 times a year on the HHL campus, 5 companies present themselves as potential employers with a short pitch. In an informal get-together that follows, students have the opportunity to talk one-on-one with company representatives and make valuable contacts. Past participating companies include Deutsche Bank, Barclays, BNP Paribas, Bridgepoint, Waterland, Oliver Wyman, Strategy&, and many others.

Company Visits - HHL on Tour

2024

- Berlin, January 2024: Point Nine (Venture Capital), Antler (Venture Capital), KPMG (Deal Advisory)

- Frankfurt, October 2024: Deutsche Bank, Bank of America, Morgan Stanley & Lincoln International (Investment Banking), Ardian & One Equity Partners (Private Equity), FTI Andersch (Consulting – Focus Restructuring), Accuracy (M&A and Dispute Consulting)

2023

- Frankfurt, September 2023: Deutsche Bank (Investment Banking), Nordic Capital (Private Equity), Ardian (Private Equity), Procter & Gamble (Consumer Goods), Morgan Stanley (Investment Banking), Danone (Consumer Goods)

- Hamburg, September 2023: Grant Thornton (M&A Advisory)

- Berlin, March 2023: N26 (FinTech), Antler (Venture Capital), KPMG (Deal Advisory), BCG (Consulting)

- Frankfurt, March 2023: Rothschild (Investment Banking), One Equity Partners (Private Equity)

2022

- Berlin, April 2022: N26 (FinTech) and Antler (Venture Capital)

- Munich, May 2022: FINN (Mobility) and Early Bird (Venture Capital)

- Frankfurt, June 2022: Deutsche Bank (Private Banking) and Ardian (Private Equity)

- Hamburg, September 2022: Grant Thornton (M&A Advisory)

HHL Finance Case Challenges - Practical Insights and Networking before your Master studies

The HHL Finance Case Challenges, held in collaboration with our esteemed corporate partners, offer a unique opportunity for Bachelor students with an interest in finance. They gain invaluable insight into the projects and working methods of leading companies, while also learning more about HHL and the content of our Master’s programs. The challenges also provide a platform for participants to expand their professional network and make valuable contacts.

Previous events:

HHL Finance Case Challenge, Leipzig Edition, November 2024

Topic: Corporate Valuation and M&A

Partners: Ardian and Oliver Wyman

HHL Finance Case Challenge, Berlin Edition, May 2024

Topic: Corporate Finance – “Make or Buy”

Partner: Deloitte

HHL Finance Case Challenge, Cologne Edition, January 2024

Topic: Restructuring and Transformation

Partner: Structure Management Partners

HHL Finance Case Challenge, Leipzig Edition, November 2023

Topic: Corporate Valuation and M&A

Partners: Ardian and Roland Berger

Typical Career Paths after Graduation

Typical Career Paths after Graduation

Max Dolata

Class of 2012

Private Equity

Director Expansion

Ardian

2016 – Present

Associate Director M&A/ECM

UBS Investment Bank

2014 – 2016

Analyst M&A/ECM

UBS Investment Bank

2013 – 2014

Interships

Ardian, HSBC, pwc

2011 – 2012

Harsimrat Chahal

Class of 2018

Strategy Consulting

Manager

Bain & Company

2023 – Present

Consultant

Bain & Company

2021 – 2023

(Senior) Associate Consultant

Bain & Company

2019 – 2021

Interships

Simon-Kucher & Partners, eccelerate, Westwing, Lecturio

2017 – 2018

Frederic v. Dallwitz

Class of 2009

Corporate Finance

Finance Director DACH & BENELUX

Danone

2019 – Present

Brand Finance Director DACH

Coty

2017 – 2019

CFO Italy and Greece

Coty

2016 – 2017

Financial Analyst / Manager

Proctor & Gamble

2010 – 2016

Malte Paul

Class of 2012

Investment Banking

Managing Director

Morgan Stanley

2020 – Present

Executive Director

Morgan Stanley

2016 – 2019

Vice President

Morgan Stanley

2013 – 2015

Various Roles

Morgan Stanley, Drueker & Co., wwg worldwidegames GmbH

2003 – 2012

What our alumni say

For me, the most important learning I took away from HHL is the approach to solving complex problems. Early in the program, students are given seemingly intractable tasks that require teamwork, analytical rigor and out-of-the-box thinking. Looking back, I am very happy that we were taught these skills, as I can hardly imagine a better training for starting a career as a recent graduate.

Maximilian Harr

Investment Banking Analyst | Goldman Sachs

Don’t miss the Full-time Master in Management | Finance study experience on our Blog! Read the Story

Start your HHL educational journey now!

Take the first application step without the HHL Entry Test or GMAT

Our student community is a carefully selected collegial network of motivated peers. We not only take hard facts into consideration, such as bachelor grades or HHL Entry Test/GMAT but also your personality, your motivation and your ambition.

Are you unsure if your profile fits with our admission criteria?

Please contact us and we will help you.

Tuition Fees and Financing Options

The investment in a FT MiM | Finance at HHL is definitely worth it. With an average starting salary of EUR 81,500 and a salary of about EUR 115,000 3 years after graduation, HHL graduates rank among the best-paid Master’s graduates (Financial Times Masters in Management Ranking 2025)!

Tuition fees

The tuition fees for the complete program amount to EUR 38,500. We offer a tuition fee reduction if you submit your complete application by the following Early Bird deadlines*:

- Early Bird 1: November 30 – Discount: EUR 4,500

- Early Bird 2: January 31 – Discount: EUR 3,000

- Early Bird 3: March 31 – Discount: EUR 1,500

This covers all tuition and examination costs and includes the tuition fees for the term abroad at one of our partner universities. And, of course, the fees do not have to be paid in one lump sum. You will pay your tuition fees in four instalments – spread out over two years. For further information, see our payment terms. One more important note: Your tuition fees are tax-deductible as an anticipated income-related expense. Check out our brochure (in German) on this for tips. Please contact your tax consultant for more information.

*In order to receive the early bird discount, you will need to submit your application by the above deadlines, as well as submit all missing documents and tests (including GMAT/GRE or HHL Entry Test) and successfully pass the HHL admissions interview until January 31 (Early Bird 1), March 31 (Early Bird 2) or June 30 (Early Bird 3).

Scholarships

Additionally, we support you in financing your Master in Management studies. Aside from our range of financing options, we award scholarships to outstanding and particularly driven applicants.

How can you secure a scholarship? Convince us of your excellent record and your exceptional personality. Contact us to learn more, we will be happy to advise you!

Scholarships Overview

Payment policy

Pay your tuition fees in installments!

After having been admitted to HHL, you are required to pay a down payment of EUR 3,000. The remaining fees will be paid as follows: The first and second installments are payable on October 1 and March 1 of the first study year. The third and fourth installments are payable on September 1 and March 1 of the second study year.

Jana Vogel

Director Program Marketing